Rare coin collecting is a venture that combines the thrill of historical discovery with the strategic acumen of investing. This multifaceted hobby offers the potential for financial reward, making rare coins attractive not just as collectibles but as a form of asset diversification. In sharing my insights garnered from three decades of dealing and collecting, I aim to provide essential knowledge for those eager to navigate the nuances of this market.

The Allure and Risks of Rare Coin Investing

Rare coin collecting is a venture that combines the thrill of historical discovery with the strategic acumen of investing. This multifaceted hobby offers the potential for financial reward, making rare coins attractive not just as collectibles but as a form of asset diversification. In sharing my insights garnered from three decades of dealing and collecting, I aim to provide essential knowledge for those eager to navigate the nuances of this market.

The Value of Coins in the Investment Landscape

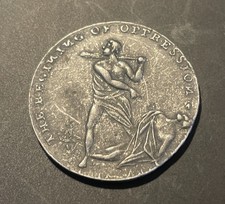

Coins are exceptional assets because they are valued beyond their monetary face value. A coin's worth accrues from its rarity, historical significance, and aesthetic appeal. When you delve into the world of coin investment, you step away from traditional financial market trends; you engage with a marketplace that thrives on scarcity and collector interest rather than solely on economic indicators.

It's important to understand that rare coins are not a catch-all alternative to bonds or stocks. They are not liquid assets that will yield instant profits. They are tangible pieces of history that require patience and considered investment. The individuals who benefit most from investing in rare coins are those who can appreciate their long-term value.

The Evolution of Coin Collecting

Coin collecting has come a long way, especially with the advent of third-party grading services in the 1980s. These services authenticate and grade coins, establishing a reliable standard that has significantly reduced investment risk. Furthermore, the digital age has broadened the scope of learning and purchasing, connecting collectors and investors globally.

Bank on Knowledge and Mentorship

Those new to coin investing would do well to find a mentor—a seasoned collector or dealer—who can educate them on the intricacies of establishing and predicting a coin's value. Reading reputable books, attending coin shows, engaging with coin clubs, and even learning through auction sites are valuable ways to deepen your understanding of this complex field.

Diversification is Key

Just as investors diversify their stock portfolios, the same strategy applies to rare coins. A well-rounded collection might include a blend of U.S. coins of different eras, foreign coins, and precious metals like gold and silver bullion coins. Each category of coins carries its own risks and rewards. For instance, 'coin flipping' - the quick buying and selling of limited-mintage coins - may seem lucrative but is often more risk-laden and unsuitable for those seeking stable, long-term rewards.

Market Bubbles and Unique Risks

The rare coin market is not immune to price bubbles. Popularity surges can inflate prices temporarily, leading to volatility in the value of given coins or series. Furthermore, each coin is unique due to its individual history and condition. Unlike shares from a company that have equivalent values, two coins of the same type can command vastly different prices due to minute differences - an aspect that both fascinates collectors and requires cautious investment.

Guard Against Counterfeits

One of the biggest threats in coin collecting is the proliferation of counterfeit coins or coins doctored to appear more valuable than they are. While experts can usually spot these fakes, beginners might fall victim to such scams. Thus, always procure coins from well-regarded dealers and insist on certifications from organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

Final Thoughts on Rare Coin Investment

Investing in coins goes beyond simply owning beautiful objects; it means understanding the subtleties of a complex market. The layers of risk are certainly present, but so are the opportunities for those who approach their collection with care and due diligence. If coins pique your interest, considering them for your portfolio could align well with your investment goals, supplementing your enthusiasm for history with the possibility of financial reward.

In closing, the journey of mastering rare coin investing is ongoing, demanding both time and careful study. It's a commitment that necessitates a thorough approach, capitalizing on educational opportunities, expert guidance, and an analytical appreciation for each coin's unique narrative. By delving into this fascinating realm, you not only diversify your portfolio but also embark on a fulfilling pursuit that marries history, art, and economic savvy.

Information for this article was gathered from the following source.